Elbit Systems: Cash Flow, Diversified Portfolio, And New Contracts Support Upside

Editor’s note: Seeking Alpha is proud to welcome AHC Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

gorodenkoff

Investment thesis

Elbit Systems

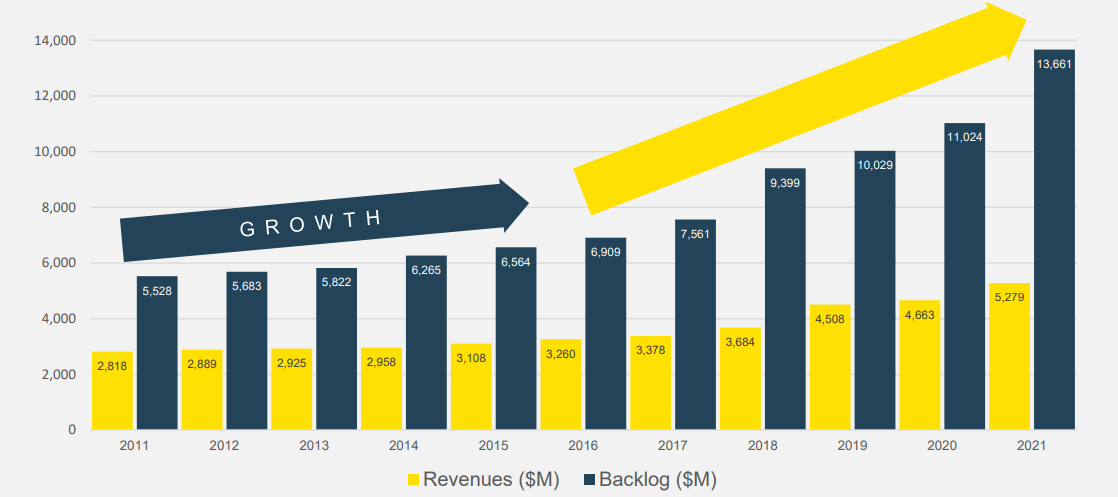

Elbit Systems (NASDAQ:ESLT) has strong international operations presenting global upside through a strong network of connections and contracts. Within its portfolio of products, the company can cover the land, air, and naval defense needs with advanced precision weaponry and vehicles that service a variety of customer (governments) needs, particularly in the growing Asia-Pacific and European segment. The company has maintained a worthwhile R&D spend, and its results are clear. Elbit has a vast portfolio of high-tech products outlined below that have generated consistent revenue and a growing backlog of recognizable revenue. Not only is their revenue backlog larger than their market cap, but their integrated global supply chain and strong balance sheet provide financial stability and upside moving forward.

For these reasons, we project Elbit Systems as a “buy” with a current 1-year price target of $247/share (+6% upside). On the same subject : Israeli defense firm Elbit selected to provide Swiss army with tactical radios.

Introduction: What is Elbit Systems?

Elbit Systems is an international high-technology defense company developing and supplying a portfolio of airborne, land, and naval products for the defense, homeland security, and aviation industry. The company was incorporated in 1966 and is based in Haifa, Israel, with 17,000 employees. They are primarily in Israel but operate through subsidiaries globally with a large presence in the US market. On the same subject : Rafael demonstrates Transparent Battlefield capabilities for German Army – Digital Battlespace. The company offers military aircraft and helicopter systems; commercial aviation systems and aerostructures; unmanned aircraft systems; electro-optic, night vision, land vehicle systems; precision munitions, and more. Elbit markets its systems and products as a prime contractor or subcontractor to various governments and companies benefiting largely from periods of conflict or instability globally. It is one of the main growth drivers and an important factor in the current investment thesis.

Elbit Systems’ Products/Pipeline

Elbit Systems Investor presentation Read also : DVIDS – News – The Joint Tactical Networking Center (JTNC) Seeks Resilient Waveforms Information from Industry.

Elbit Systems’ product line is impressively wide-ranging with new developments consistently being launched. The current Russian-Ukrainian conflict has driven greater interest in competitively advanced defense systems, which makes Elbit’s product portfolio of great importance globally. As seen below, Elbit manufactures and sells the whole suite of defense products covering radio communication systems, cyber intelligence, autonomous and semi-autonomous vehicles and aircraft, laser systems, guided rocket systems, armored vehicles, and precision munitions, amongst others.

Elbit Systems Investor presentation

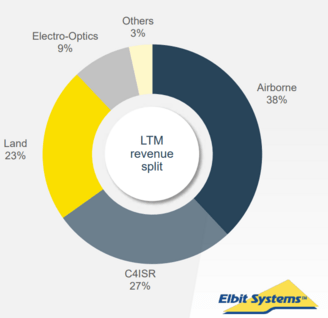

Revenue is primarily derived from their airborne product systems at 38% (e.g. helicopters, electronic warfare, etc.) followed by their C4ISR segment (27%) which includes the command and control systems products, com-networks, naval and maritime products, and more. Several products have been successful in both being cutting edge and being awarded lucrative contracts. This was most recently seen on June 30th, 2022 when they announced their 4-year $548 million contract to supply an undisclosed country in the Asia-Pacific with the Elbit TIGER-X networking middleware, TORCH-X C&C systems, and SDR radio systems.

Management/Strategy

Elbit Systems Investor presentation

Bezhalel Machlis has led Elbit Systems as President and Chief Executive Officer since April 2013. From 2008 to 2012, he served as general manager of the land and C4I division. He has also served across various other business lines including ground, battlefield, and information systems. Bezalel Machlis joined Elbit in 1991 and held various management positions in the battlefield and information systems area. Before that, he served as an artillery officer in the IDF, where he holds the rank of colonel (reserves). Bezalel Machlis holds a Bachelor of Science degree in Mechanical Engineering and a Bachelor of Arts degree in computer science from the Technion and an MBA from Tel-Aviv University. He is a graduate of Harvard University Business School’s Advanced Management Program and is a promising leader for Elbit.

Financial Situation

Elbit Systems Investor presentation

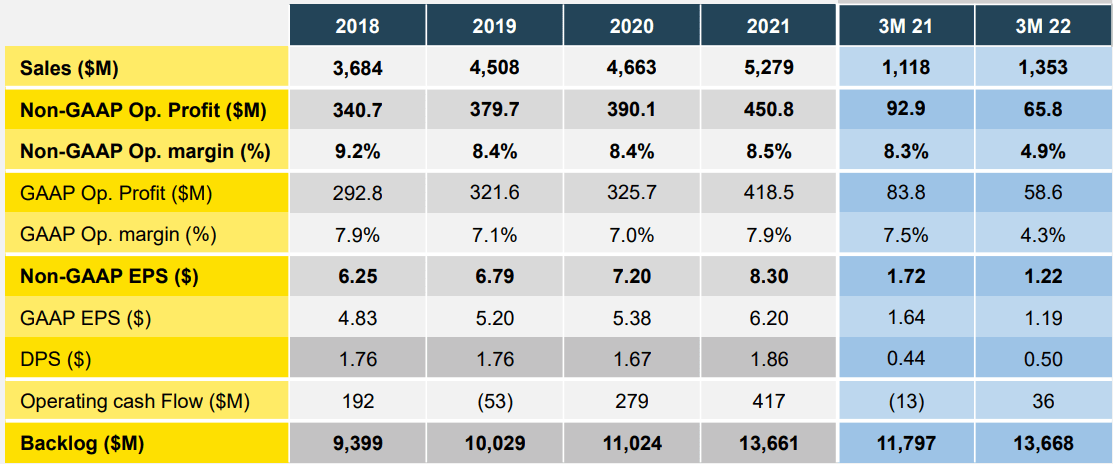

Elbit Systems has shown strong financial performance according to its earnings report which includes a substantial budget for R&D ($100.7 million | 7.4% of revenues) in the first quarter of 2022, as compared to $84.3 million (7.5% of revenues) in the first quarter of 2021. This is primarily attributed to the increased launch of new products across their expansive product offering. They also retain a positive allocation for marketing and selling expenses ($87 million | 6.4% of revenues) in the first quarter of 2022, as compared to $51.5 million (4.6% of revenues) in the first quarter of 2021. These remain necessary expenses seemingly under control relative to revenue.

Elbit’s operating income was $3.7 million in the first quarter of 2022 and was a result of capital gains from the sale of part of the activities of a subsidiary in the UK and is largely not expected to continue. It remains only a small portion of overall operating income ($65.8 million | 4.9% of revenues) in the first quarter of 2022, as compared to $92.9 million (8.3% of revenues) in the first quarter of 2021. Other expenses, in 2022 and 2021, were mainly related to non-service costs of pension plans. Taxes on income were $8 million in the first quarter of 2022, as compared to $10.8 million in the first quarter of 2021. The decrease in profit is largely related to business development (R&D and selling expenses) but still provides sufficient profitability without sacrificing medium-term growth.

Elbit Systems Investor presentation

GAAP operating income in the first quarter of 2022 was $58.6 million (4.3% of revenues), as compared to $83.8 million (7.5% of revenues) in the first quarter of 2021. GAAP and Non-GAAP operating income in the first quarter of 2022 was reduced by expenses of approximately $35 million related to the Company’s stock price-linked compensation plans, a necessary measure for retaining top talent. Financial income was $1.1 million in the first quarter of 2022, as compared to financial expenses, net of $0.2 million in the first quarter of 2021.

In terms of financial stability, Elbit Systems’ latest twelve months DEBT/EBITDA ratio was 2.0x, and looking back to the past 5 years peaked this year primarily driven by the increase in expenses. This still isn’t concerning.

Risk Discussion

Elbit Systems is obviously in a good financial position. According to the current political situation in the world, Elbit is largely benefiting from the instability lowering its risk profile and hedging other market positions that may not benefit from the current situation. It’s a positive environment for defense and military companies to attract new investors and retain high multiples.

At the same time, Elbit Systems’ global presence lowers its revenue-concentration risk and supports further growth through the cycle while reducing country-specific risks. Elbit will still need to outcompete its competitors, but we find this likely due to the established relationships and revenue backlog attained thus far.

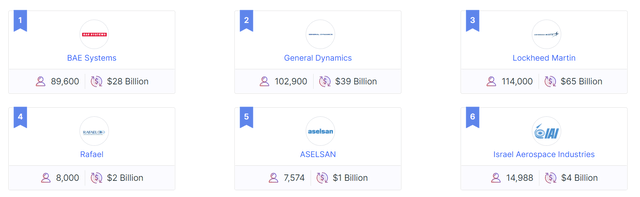

ZoomInfo – Elbit Competitors

The increased demand for defense products also increases competition and competitors should be monitored as well for large contracts that may take up overall defense budgets in a given year. Elbit Systems offers an innovative solution with stable growth and a large backlog of contracts on top of a strong financial position. This makes its risk profile reduced and should make existing and new investors feel positive about the future growth of the company.

Elbit Systems Valuation

Author Expectations

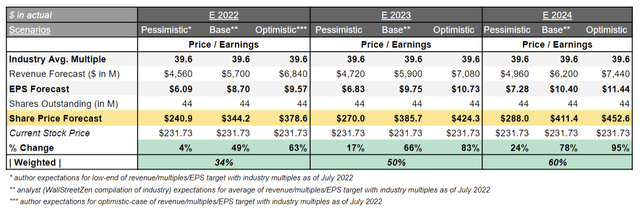

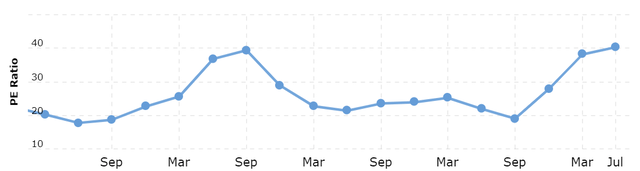

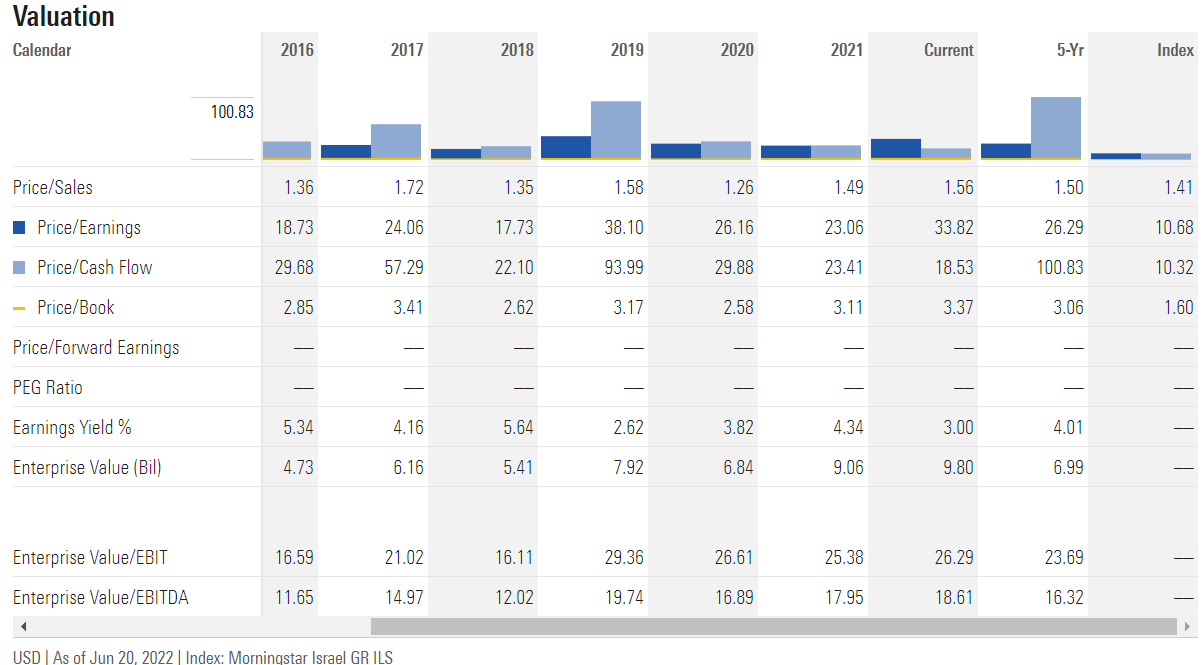

Several factors affect Elbit Systems’ valuation including its consistent earning yield growth up to 4.34% per year since 2021. This is on top of impressive recent cash flow growth y/y of +49.5% from 2021/2020. The price/earnings ratio a month was 33.8x which is only minimally higher than the defense industry average of 30x, but considerably higher than the broader index of 10.68x attributed to the current conflict-driven environment. This has since increased to 39.6x based on the newly awarded contracts cited above. The higher multiple is warranted largely due to outsized growth. It is also supported by higher-than-average revenue backlog and cash flow growth.

Macro Trends – Elbit Systems 2018-2022 PE Ratio

If we push the multiples forward and incorporate analyst expectations, we can see that there is substantial upside in a scenario whereby expected revenue growth translates to earnings and thus a higher valuation. Based on the quite high P/E ratio of 39.6x that Elbit currently has, there is substantial potential for Elbit to easily exceed the $300/share mark. We find it quite likely based on recent contracts that such potential exists, but we are tempered by analyst expectations outlined in the section below.

This tempered opinion is largely due to the fluctuation in what investors are willing to pay per dollar of earnings. In the historical P/E ratio, we can see a wide fluctuation over the past three years, 2018-2022. In September 2018, what we call the pre-militarization era, we can see an 18.6x PE ratio which is 47% of the current P/E ratio, and would drop our valuation estimates to $161.8/share. It is unlikely sentiment and future growth will drop to such levels in the near term, 3 years forward, but with a historical average 3-year P/E ratio from 2018-2022 of ~26.3x, the price target would only reach $229.2/share. These data points are meant to explain the value of sentiment on Elbit and to affirm why we expect over the next 12 months for Elbit to not likely reach the $300/mark. We expect Elbit to remain around a P/E ratio of ~ 28.4x as the analysts seem to expect, based on the analyst EPS estimate, and an adjusted P/E ratio to match the price target. It is not to say that Elbit won’t reach >$300/share, but the sentiment and thus the defense era we are now in must remain for Elbit to reach this potential. Investors should watch EU armament and global military systems upgrades closely over the next 12 months to understand the likely trend towards increased Elbit contracts or fewer contracts. We expect a gradual slowdown of military system upgrades, but still above the 3-year historical rates.

Morning Star

ESLT Price Target

We recommend ESLT as a “long” position. With a “bullish” recommendation according to our research of broader opinions, Elbit is well-liked in the industry and earned its recommendation as a “strong buy” offering 12-month price forecasts for the median target of $233.50/share with a high estimate of $247/share and a low estimate of $220/share.

CNN Money

The median estimate represents less than a 1% percent upside from the current price of $231/share and after the most recent announcements, it seems unlikely to remain this low. We find this estimate to be conservative given the above factors and the recent announcements of several new contracts and cooperation agreements including the July KMW MOU, Universal Avionics contract for $33 million, and the July $660 million European intelligence contract, amongst others. Our valuations estimate that it would require a slight deterioration in growth estimates from current levels and would likely place We find the high estimate for the next 12 months to be likely offering a 6.7% upside this year and expectations of continued growth thereafter.

Conclusion

In summary, Elbit Systems LTD is a very interesting company from Israel that has started to take significant portions of the global market share with its novel technologies and impressive government connections.

Airborne and Defense segments are extremely volatile, but there is a large demand from investors in the current political situation thus aiding a consistently high multiple. Innovative developments are expected to continue with the company’s newest branches into artificial intelligence and laser systems expecting to bring about a new level of warfare technologies driven by deep-tech expertise. Elbit Systems is one of the few defense companies that can operate at this level of innovation while retaining a strong financial position.

In summary, we project Elbit Systems as a “buy” with a current 1-year price target of $247/share (+6% upside).

Comments are closed.