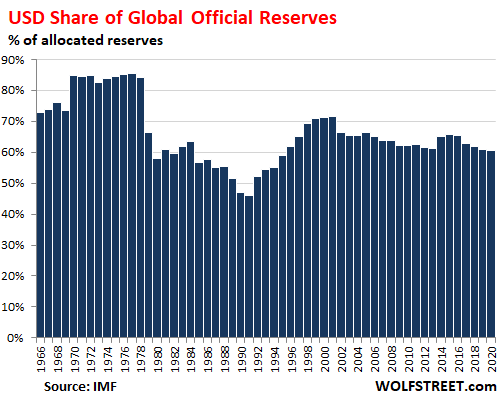

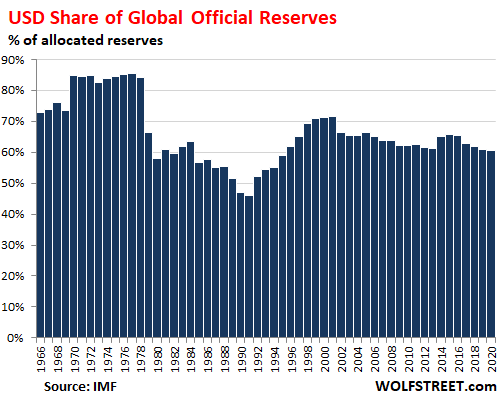

US Dollar as “Global Reserve Currency” amid Fed’s QE and US Government Deficits: Dollar Hegemony in Decline

Other options are also unstable. Central banks are hated by the Chinese yuan, their share is still insignificant. The share of the euro remained. But the share of the yen is growing.

From Wolf Richter for WOLF STREET.

The position of the US dollar as the dominant world reserve currency is an extremely important factor in supporting bubbling US government debt,, The drunken imprint of Fed moneyand Corporate America’s ambition to offshore production to low-cost countries, thus creating huge and ever-increasing trade deficits. They have all become dependent on the willingness of other central banks to hold large amounts of dollar-denominated securities. But from the looks of it, these central banks may be getting a little nervous.

The global share of US dollar-denominated foreign exchange reserves – US securities, US corporate bonds backed by mortgage-backed securities, etc., held by foreign central banks – fell to 60.5% in the third quarter, according to the IMF. Read also : Protecting High-Level Personnel from IMSI Catchers. of COFER. This is the lowest since 1995. Over the last six years, the share of the dollar has been declining at a rate of about 1 percentage point per year:

The 20-year decline of the dollar.

Dollar-denominated global foreign exchange reserves do not include the Fed’s own holdings of dollar-denominated assets that it has purchased as part of QE, such as $ 4.6 trillion in U.S. Treasury securities and $ 2.1 trillion in U.S. mortgage-backed securities.

The decline in the share of the dollar began 20 years ago, when the euro took the place of previous currencies, including the Deutsche mark, which were previously in the basket of foreign exchange reserves. Read also : Elon Musk Offers $100 Million Carbon Capture Prize – Bloomberg. But that 20-year drop of 10 percentage points is fading from a nearly 40-point drop in the dollar’s share from 1977 (85%) to 1991 (46%), followed by a 25-point jump to 2000.

For now, the motto between these central banks, together, seems to be: it’s easy. Nobody wants to cause a sudden crisis (2020 = Q3):

The euro remained at a 20% share. Dreams of “dollar parity” linger until the next announcement.

The United States of the euro area had a large trade surplus with the rest of the world, especially the United States. Their currencies were already reserve currencies. On the same subject : Tencent Top Holder Prosus to Sell Up to $14.6 Billion Stake. So since the euro became the official currency and with the expansion of its members from the original 5 to now 19, there has been talk of the euro eventually reaching “parity” with the dollar as a reserve currency. But the euro debt crisis put an end to this conversation when the euro-denominated government debt issued by Greece failed to meet its obligations.

Since then, the euro’s share has remained between 19.5% and 20.6%, although the euro area now covers 19 Member States. In the third quarter, the share of the euro was 20.5%. The euro was the last effort of a currency to dethrone the dollar.

The Chinese renminbi does not count yet.

The RMB became the official reserve currency in October 2016, when the IMF included it in its basket of currencies that support special drawing rights (SDRs). It was rumored that the next currency would dethrone the dollar. But at first glance, this will require more patience than is expected of mortals.

After four years in the SDR basket, the share of the yuan in the third quarter was still only 2.13%. But, but, but … it was ahead of the Swiss franc (0.17%), the Australian dollar (1.73%) and the Canadian dollar (2.0%).

If the share of RMB continues to grow at the rate of the last two years, it will take 110 years to reach 20%. At this rate, this will not be a threat to the dollar in the life expectancy of the average Gen Z member. But things are moving slowly, while suddenly moving fast; and we can’t draw a straight line for 110 years. RMB is the short red line in the spaghetti at the very bottom (more on these spaghetti after a while):

The rise of the Japanese yen.

To look at the spaghetti at the bottom of the chart above, we need to take out our magnifying glass, and the table below does that. What stands out is the rise of the yen, now with a share of nearly 6%, compared to 3.5% in 2015, far ahead of the rise of RMB. This made the yen the third largest reserve currency.

Japan is in the worst financial condition of any country in this group or of any major country; and Japan is also the most ruthless money printer in any major country. But there is usually a large trade surplus with the rest of the world, and faith in the yen, including by the Japanese themselves, remains unshakable.

The share of the pound sterling (GBP) remains approximately 4.5%, despite the chaos of Brexit in 2016, making it the fourth largest reserve currency.

The eurozone and Japan – with reserve currencies №2 and №3 – usually have large trade surpluses with the rest of the world. This shows that the economy of the main reserve currency should not have a trade deficit. The United States did not have a permanent trade deficit until the early 1990s. There were years before that, when there was even a trade surplus. The persistent trade deficit only disappeared in the mid-1990s and has since exploded amid the frantic “globalization” of Corporate America. The dollar is the largest reserve currency activated The United States can easily finance its large trade deficits, which allows the United States to even have these large trade deficits.

If the dollar’s status as a leading global reserve currency deteriorates much, it will shake this equation. With declining rates over the past six years, it will take a decade for the dollar to fall to 50% while other currencies will remain. But to shake the equation, the share of the dollar will probably have to fall well below 50%.

“Make it easy” is still the motto of reserve currencies. And it works until all of a sudden, for whatever reason, things get off track. But until something derails, the movements are slow and steady and span decades.

An increasingly important issue, because someone always has to buy this debt – and it’s not just the Fed. But the share of foreign owners is declining. Read… Who bought the monstrous $ 4.2 trillion added to America’s incredibly sharp national debt in 12 months? All but China

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I completely understand why – but I want to maintain the site? You can donate. I appreciate it extremely. Click on the beer and iced tea mug to find out how:

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.

![]()

Comments are closed.